- TSX: MIN

- OTCQB: EXMGF

American Low Cost Copper ![]()

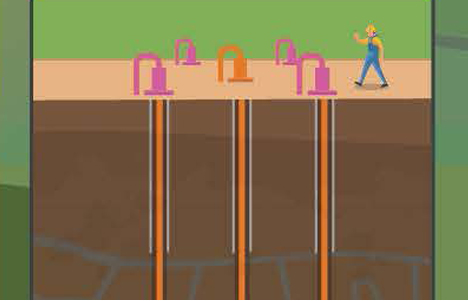

Excelsior Mining Corp. is a copper production company that owns and operates the Gunnison Copper Project in Cochise County, Arizona. The project is a low cost, environmentally-friendly "green" copper operation, permitted to 125 million pounds of copper cathode production annually.

We are developing the world's most eco-friendly copper project. We also own the past-producing Johnson Camp Mine, which we plan to restart, and numerous other exploration projects, including the Strong and Harris & Peabody Sill Deposits.

Stock Quote

TSX: MIN