June 16, 2010

Excelsior Mining Corp. (TSX-V: MIN) (“Excelsior”) is pleased to announce that it has entered into a letter of intent dated June 16, 2010 with AzTech Minerals, Inc. (“AzTech”), a company incorporated under the laws of Arizona, to combine their businesses to create a well-funded, low-cost, growthoriented, gold and copper exploration and development company. The two companies have agreed to combine on the basis of two common shares of Excelsior being issued for each outstanding share of AzTech. As part of the transaction, and prior to any Excelsior common shares being issued to AzTech shareholders, Excelsior will consolidate its issued and outstanding common shares on the basis of one post-consolidation common share for every three common shares outstanding.

The transaction is subject to the execution of a definitive agreement (the “Definitive Agreement”), approval of the TSX Venture Exchange (the “Exchange”), approval of the AzTech and Excelsior shareholders and other conditions customary for a transaction of this nature.

Highlights of the transaction include:

- Excelsior common shares to be consolidated on a three for one basis with the result that there will be approximately 5.87 million post-consolidation common shares of Excelsior outstanding.

- Excelsior to issue approximately 33.57 million shares in exchange for 100% of the outstanding AzTech shares which will represent 85.12% of Excelsior's shares outstanding after consolidation and closing of the transaction.

- AzTech warrants and options will be exercisable into Excelsior shares at the two to one exchange ratio.

- The transaction must be approved by AzTech and Excelsior shareholders.

- Completion of the transaction is expected to occur prior to August 31, 2010.

It is anticipated that Excelsior and AzTech will enter into a business combination by way of an amalgamation, arrangement, exempt takeover bid, merger or other similar form of transaction whereby Excelsior would acquire all of the issued shares of AzTech and AzTech would become a wholly-owned subsidiary of Excelsior (the “Transaction”). Full details of the Transaction will be included in the Definitive Agreement and Management Information Circular to be filed with the regulatory authorities and mailed to Excelsior shareholders in accordance with applicable securities laws. It is anticipated that a special meeting of shareholders of Excelsior will be held in August 2010 to approve the Transaction.

In conjunction with, or prior to the closing of the Transaction, AzTech will complete a brokered private placement of subscription receipts of AzTech (“Subscription Receipts”) for gross proceeds of at least US$3,000,000 at a price per Subscription Receipt equal to US$1.00. Each Subscription Receipt will be exercisable for one (1) common share of AzTech (which will be exchanged for two common shares of Excelsior) upon satisfaction of all conditions to the Transaction. BayFront Capital Partners Ltd. will act as agent on a best efforts basis in connection with the brokered private placement.

On completion of the transaction, Stephen Twyerould will become Chief Executive Officer and President of the combined company, Roland Goodgame will become Vice President of the combined company and Mark Morabito will remain as Chairman of the combined company. The Board of Directors of the combined company will consist of Mark Morabito (Chairman), Stephen Twyerould, Roland Goodgame, John Vettese, Jay Sujir and Colin Kinley.

AzTech has engaged BayFront as its financial advisor and Cassels Brock & Blackwell LLP as its legal advisor in respect of this Transaction. Excelsior has engaged Blake, Cassels & Graydon LLP as its legal advisor in respect of this transaction.

Project Highlights

- AzTech has the option to acquire 100% ownership of the Gunnison Copper Project located in Arizona (the “Project”). Highlights of the Project include:

- Currently defined JORC inferred resource of 4.77 billion pounds of copper (787 million tons at 0.30% copper)*, which remains open for expansion

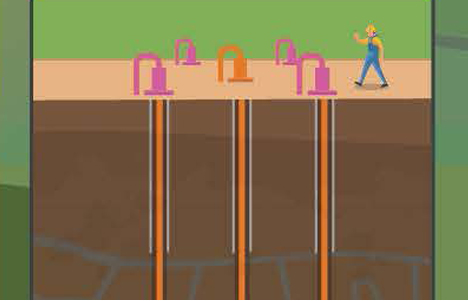

- Two-thirds of the copper occurs as oxide copper, which has the potential to be mined using in-situ recovery (ISR) methods

- Several ISR operations for copper have operated or been permitted in Arizona including San Manuel (BHP-Billiton), Silver Bell (ASARCO), etc.

- Located within the copper porphyry belt of Arizona, 65 miles southeast of Tucson

- Contains two deposits, North Star and South Star

* The Inferred Mineral Resource estimate complies with recommendations in the Australasian Code for Reporting of Mineral Resources and Ore Reserves (2004) by the Joint Ore Reserves Committee (JORC). Therefore it is suitable for public reporting. The estimate has an effective date of June 15, 2010 and was completed under the overall supervision and direction of Herb Welhener of Independent Mining Consultants, who is a competent person as defined by the Australasian Code for the Reporting of Mineral Resources and Ore Reserves (JORC Code) 2004 Edition. Herb Welhener is independent of AzTech and Excelsior for the purposes of National Instrument 43-101. The JORC inferred resources comply with recommendations in CIM Standards on Mineral Resources and Reserves Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions.

AzTech has commissioned a National Instrument 43-101 technical report (the “Technical Report”) on the Project, which is expected to be completed and filed with the TSX Venture Exchange for review in connection with the proposed transaction. Further information on the Project and future exploration programs will be announced once the Technical Report has received regulatory approval and has been filed on SEDAR.

Completion of the Transaction is subject to a number of conditions, including Exchange acceptance and disinterested shareholder approval. The transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the Management Information Circular to be prepared in connection with the Transaction, any information released or received with respect to the Transaction may not be accurate or complete and should not be relied upon. Trading in the securities of Excelsior should be considered highly speculative.

The TSX Venture Exchange has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this press release.

Further details about Excelsior can be found on Excelsior’s website at: http://www.excelsiormining.com/.

ON BEHALF OF THE EXCELSIOR BOARD

"Mark J. Morabito"

CEO

T: 604-681-8030

F: 604-681-8039

www.excelsiormining.com

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as "anticipate", "believe", "plan", "estimate", "expect", and "intend", statements that an action or event "may", "might", "could", "should", or "will" be taken or occur, or other similar expressions. All statements, other than statements of historical fact, included herein including, without limitation; statements about the terms of the Transaction and the private placement, are forward-looking statements. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; operational risks associated with mineral exploration; fluctuations in commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the potential for conflicts of interest among certain officers, directors or promoters with certain other projects; the absence of dividends; competition; dilution; the volatility of our common share price and volume and the additional risks identified the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the TSX Venture Exchange and applicable Canadian securities regulations. Forward-looking statements are made based on management's beliefs, estimates and opinions on the date that statements are made and Excelsior undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release, and no securities regulatory authority has either approved or disapproved of the contents of this release.