Dear Fellow Investors,

With the copper spot price teetering at just above $2, you might be skeptical hearing a mining executive talking about how great things are, but the fact is 2015 was by far the most productive year in Excelsior’s history. From the successful completion of our feasibility-level work program, through to the recent acquisition of the Johnson Camp Mine with the concurrent financing, it was a noteworthy year. What makes this even more remarkable is that we accomplished all of this within the context of one of the most challenging mining environments in recent memory. Not intent on simply surviving; we have continued to move forward quickly.

Some of the more significant milestones for the year included:

- Exercise of the option to acquire 100% of the Gunnison Copper Project;

- Successful completion of feasibility level field programs, including resource drilling, metallurgy, hydrology and base-line studies;

- Upgrading of the North Star resource;

- Completion of detailed hydrological modelling in support of permitting and mine design; and,

- Acquisition of the nearby Johnson Camp Mine with a concurrent US$12 million financing.

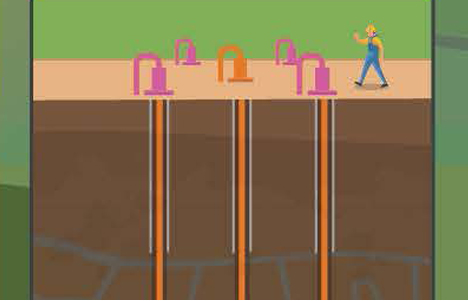

The acquisition of the Johnson Camp Mine (“JCM”) is significant for several reasons. The existing facilities and the solvent extraction and electro winning (SX-EW) plant are valuable assets. We remain absolutely confident in our ability to successfully process copper solutions through the SX-EW plant at JCM, which is expected to significantly reduce both our initial capital requirements and the time required for the start-up of the Gunnison Copper Project. By combining industry leading low operating and low capital costs with an environmentally friendly mining project, we further differentiate ourselves from our peers.

The JCM acquisition included a US$12 million financing that demonstrates our continued ability to access funds in these challenging economic times. Of note, US$8 million of this was in the form of a non-dilutive royalty offering, demonstrating our focus on shareholder value. With the extensive and all-encompassing due diligence reviews involved in this type of financing, we again have received a major endorsement of the quality of our management team and the Gunnison Copper Project.

Looking forward, we are excited to show the positive financial effects of the JCM acquisition by releasing, early in 2016, a major update to our prefeasibility study. This will go hand-in-hand with the submittal of our main in-situ recovery operating permits – the Arizona State Aquifer Protection Permit and the Federal Underground Injection Control Permit. Both are significant milestones and market catalysts.

Later in 2016 we expect to complete the full feasibility study on the combined project, delivering yet another major catalyst to the market.

The only thing missing from an otherwise exceptional year is a higher share price. By staying virtually flat, Excelsior will be one of, if not the, top performing copper development company for 2015 on the TSX-V. I’m fully aware this is still not good enough. I have always maintained that a technical success is nothing if it does not coincide with a market success. Without a doubt we have created substantially more value during the past few years than the softening copper price has taken away, and we are clearly doing a good job of navigating through these troubled markets. I believe the stability of our current share price is a reflection of the quality of our project and the capacity of our management team to deliver.

Finally, I truly appreciate those of you who have continued to support Excelsior as we grow to be one of the most cost effective and environmentally friendly copper mines in the world. Excelsior has never looked better and our path to low-cost production has never been clearer. We enter 2016 with confidence and optimism, knowing the light at the end of the tunnel is nearer and we are poised to capitalize on all the outstanding work we have done to date. Thank you for your support.

Kind Regards,

Stephen Twyerould

President & CEO

Excelsior Mining Corporation

About Excelsior

Excelsior is a mineral exploration and development company that is advancing the Gunnison Copper Project. The Excelsior management team consists of experienced professionals with proven track records of advancing mining projects into production. Further information about the Gunnison Copper Project can be found in the technical report filed on SEDAR at www.sedar.com entitled: “Gunnison Copper Project, NI 43-101 Technical Report, Prefeasibility Study” dated February 14, 2014.

Dr. Stephen Twyerould, Fellow of AUSIMM, President and CEO of Excelsior, and a Qualified Person as defined by NI 43-101, has reviewed and approved the technical information disclosed in this letter.

For more information on Excelsior, please visit our website at www.excelsiormining.com.

Cautionary Note Regarding Forward-Looking Information

This letter contains "forward-looking information" concerning anticipated developments and events that may occur in the future. Forward looking information contained in this letter includes, but is not limited to, statements with respect to (i) the use of the SX-EW plant at Johnson Camp, (ii) the potential reduction in the initial capital costs and the timeline to first production at the Gunnison Project, (iii) the timeline to complete a prefeasibility study and feasibility study, (iv) the timeline to submit permit applications, (v) expected low cost production; and (vi) the advancement of the Gunnison Project.

Such forward-looking information can be identified by the use of the word “will”. Forward-looking information contained in this letter is based on certain factors and assumptions regarding, among other things, the estimation of mineral resources and mineral reserves, the realization of resource and reserve estimates, copper and other metal prices, the timing and amount of future exploration and development expenditures, the ongoing care and maintenance costs associated with Johnson Camp, the estimation of initial and sustaining capital requirements, the estimation of labour and operating costs, the availability of necessary financing and materials to continue to explore and develop the Gunnison Project in the short and long-term, the progress of exploration and development activities, the receipt of necessary regulatory approvals, the completion of the permitting process, the estimation of insurance coverage, and assumptions with respect to currency fluctuations, environmental risks, title disputes or claims, and other similar matters. While the Company considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect.

Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks inherent in the exploration and development of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined including the possibility that mining operations may not commence at the Gunnison Project, risks relating to variations in mineral resources and reserves, grade or recovery rates resulting from current exploration and development activities, risks relating to the ability to access infrastructure, risks relating to changes in copper and other commodity prices and the worldwide demand for and supply of copper and related products, risks related to increased competition in the market for copper and related products and in the mining industry generally, risks related to current global financial conditions, uncertainties inherent in the estimation of mineral resources, access and supply risks, reliance on key personnel, operational risks inherent in the conduct of mining activities, including the risk of accidents, labour disputes, increases in capital and operating costs and the risk of delays or increased costs that might be encountered during the development process, regulatory risks, including risks relating to the acquisition of the necessary licenses and permits, financing, capitalization and liquidity risks, including the risk that the financing necessary to fund the exploration and development activities at the Gunnison Project may not be available on satisfactory terms, or at all, risks related to disputes concerning property titles and interest, environmental risks and the additional risks identified in the “Risk Factors” section of the Company’s reports and filings with applicable Canadian securities regulators.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. The forward-looking information is made as of the date of this letter. Except as required by applicable securities laws, the Company does not undertake any obligation to publicly update or revise any forward-looking information.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release, and no securities regulatory authority has either approved or disapproved of the contents of this release.